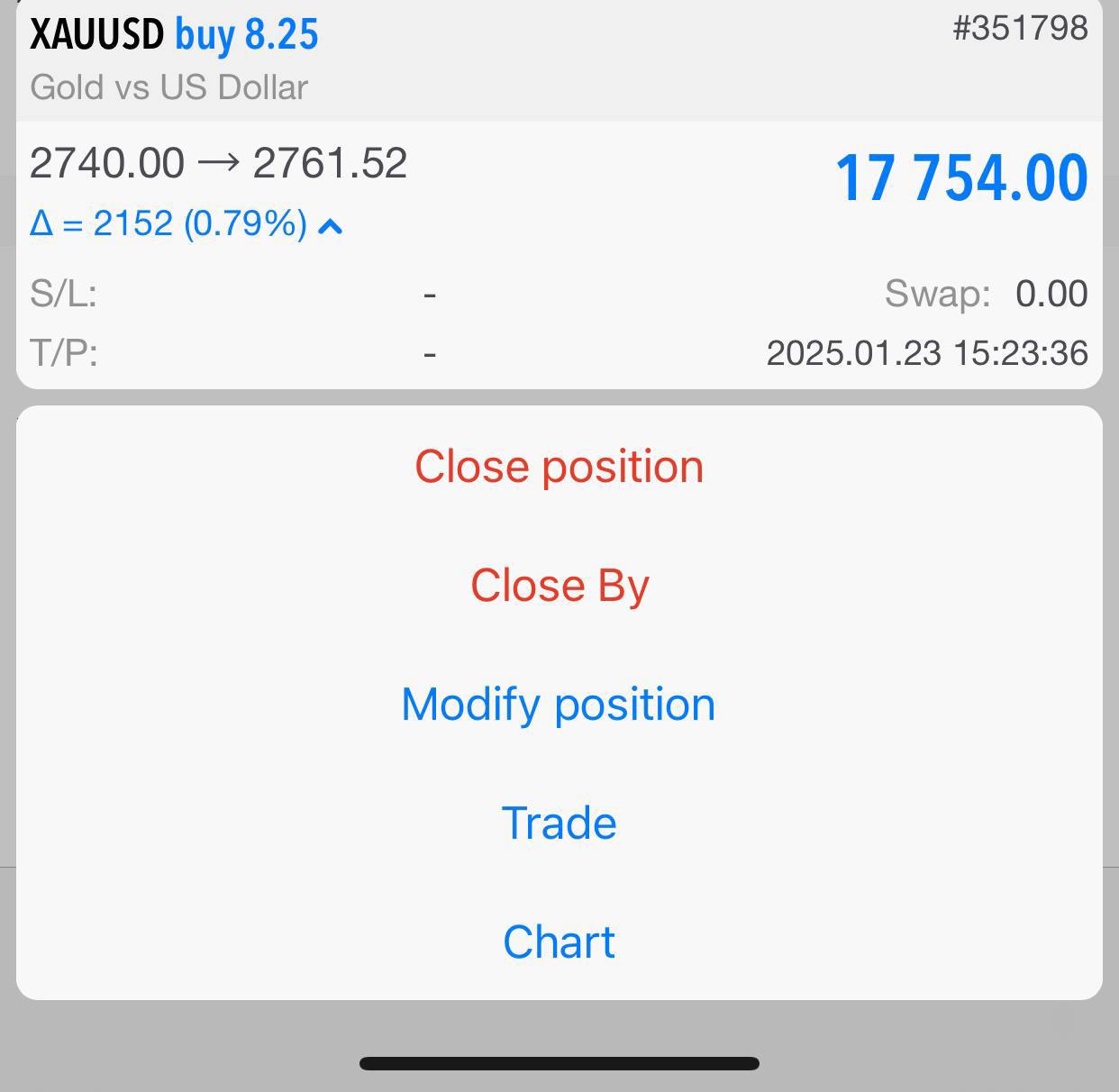

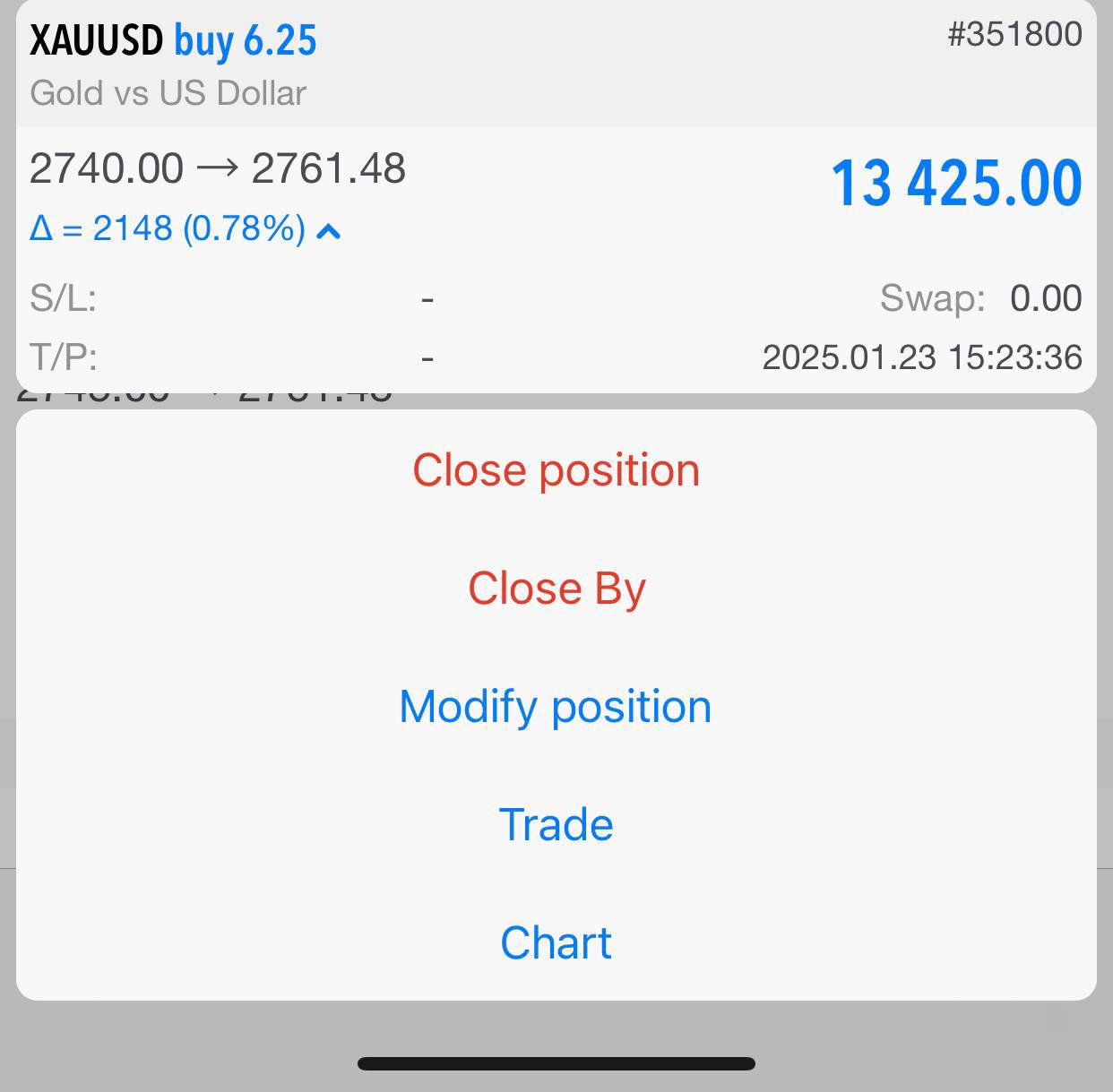

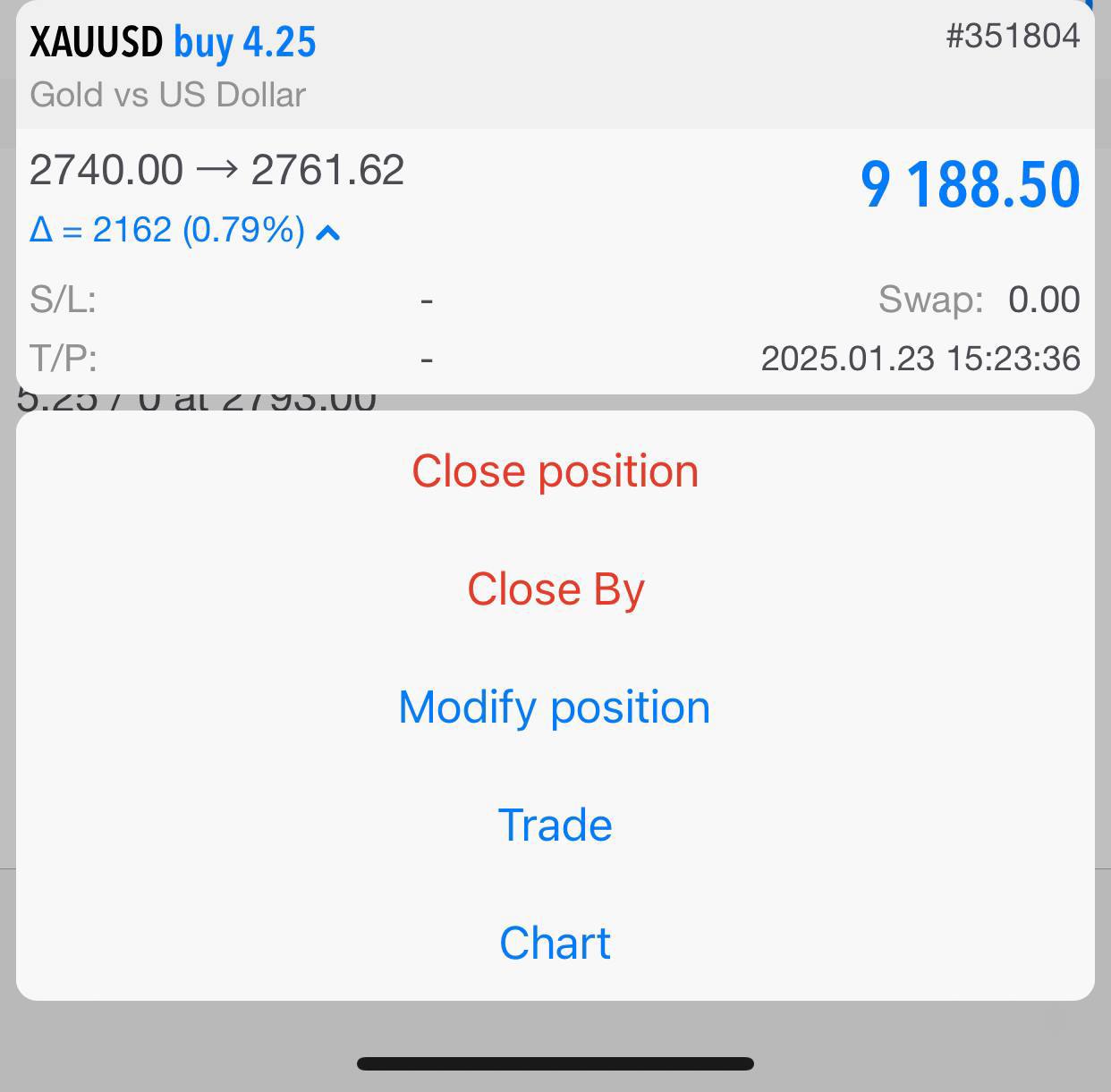

Gold and BTC Investment Club

👏👏Welcome to our investment channel and start your investment journey. We update gold analysis reports, market forecasts, trading strategies and financial information every day. 🤝For cooperation, please contact me :@WinDoubleG Связанные каналы | Похожие каналы

6 409

obunachilar