Gold and BTC Investment Club

👏👏Welcome to our investment channel and start your investment journey. We update gold analysis reports, market forecasts, trading strategies and financial information every day. 🤝For cooperation, please contact me :@WinDoubleG Связанные каналы | Похожие каналы

6 486

подписчиков

Популярное в канале

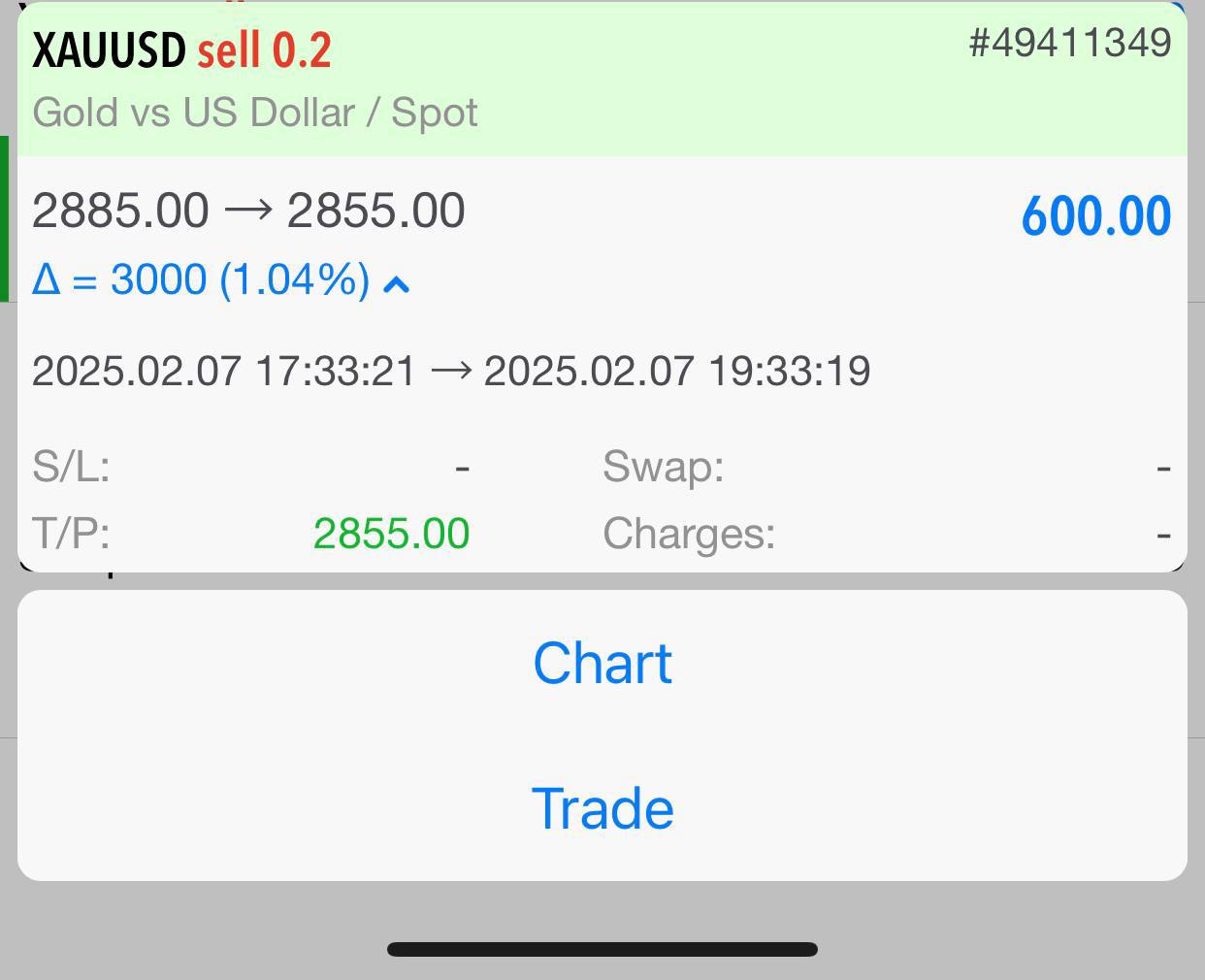

#XAUUSD Sell 2920-2923 2927-2930 Sell more TP1 2917 TP2 2914 TP3 2911 TP4 2908 TP5 2905 TP6 2900 ...

Пост #13903:

Фото

Пост #13913:

Фото

#XAUUSD Sell 2918-2920 2925 Sell more TP1 2915 TP2 2912 TP3 2909 TP4 2906 TP5 2903 TP6 2900 SL:29...

#XAUUSD Sell 2945 2950 Sell more TP1 2940 TP2 2935 TP3 2930 TP4 2925 TP5 2920 TP6 2915 SL:2957(Or...